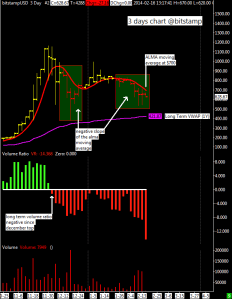

BTC/USD is trading beneath its 50 day moving average today as I write this, that average is now at $780. Coupled with the high volume on the downside, especially in the last 10 days, this is solid evidence for a reversal of the short term market trend from up to down.

BTC/USD is trading beneath its 50 day moving average today as I write this, that average is now at $780. Coupled with the high volume on the downside, especially in the last 10 days, this is solid evidence for a reversal of the short term market trend from up to down.

I think that BTC/USD will drop 200 dollars from here down to the long term support, my long term VWAP calculated using last one year of data.

If I am right about this the prognosis calls the bottom should develop as a conseguence of the MtGox drama, that exchange (if we can call it an exchange…) is almost out of business, my guess is that it is down of bitcoins and with strong manipulations of the price they are trying to recover the money lost due to the malleability issue from their own customers, this practice is of course totally illegal in a regulated market, i don’t want to go in the details but looking MtGox price and volume data there is a strong evidence of such activity.

Back to our long term chart, is this the start of a bear market? I think it is too early to tell. The 200 day moving average is around my long term VWAP so a drop under it would be the first clue that a bear market has begun. Also the other kind of average i use, the ALMA moving average, turned negative during the prolonged trading range of January.

I added a new indicator, similar to my “net volume” indicator, the only difference is that it computes the ratio between buyers and sellers and it has been remarkably accurate staying in bearish territory since November top; it looks good as a trend following tool.

For the short term i think the price is now in a congestion in the $520-$720 price zone, a strong bottom where to shake out all weak hands is necessary and very healthy in my view and if this event will be accompanied by MtGox going out of business indefinitely, then the bitcoin market will be ready to move up again.

So where to buy? 520 or 420?

My bets currently are on 510. When the price on Mt Gox drops $100, on Bitstamp it drops $50. Mt Gox is now floating around $100, Bitstamp on 560. Not sure if panic selling will be extra when Mt Gox announces bankruptcy or the likes, but there seems a lot of support around 500. Anyway, just my guts feelings…

thx!

Gox has made such an insaije amount of money over the years that I can’t really understand why they are playing this shady game now. I usually think of Magic the card game players as typically good well to do nerds…no more.

So people can still move btc out of gox right? Why hasn’t everyone bought what they could at gox, then moved to Coinbase and sold? I would expect the only ones left should be those in withdrawl limbo/frozen and the ones that took a huge hit and are holding. Is this inaccurate?

not right now … btc withdrawls are suspended until further notice. so no such thing as moving to another exchange. the only thing to do is convert to fiat … and hope that the amount does not go “poof” the same way Bitcoins might on Gox.

Good read, thanks. 7,072.99 BTC short at BFX agress that it’s the bearmarket. 🙂 I for one will be selling all attempts up for quite a while.

And you’re not alone in thinking that emptygox just goes into their little sql database and puts whatever figures they feel like in their self-trading account. You may not be aware of this but it came out that bitcoinica had a self-trading account where they did this after they closed up shop – and guess what? they managed to trade at a net loss even though they had “unlimtied” amounts to use for positions..

same here will attempt selling when we reach up high close to 700s if we ever do. were gonna be in this congestion (520 to 720 for a while).

but if mt gox will fix the withdrawal issues tomorrow bitcoin might fly up, right?

Not really. They said they will allow withdrawals with limits after the 20th, which is another proof they are insolvent. And trying to buy themselves as much time as possible. What’s most disgusting is Roger Ver’s behavior – he’s offering people to buy their Mt.Gox bitcoins and dollars at a discounted rate. Him being buddies with Mark Karpeles makes me think this is another trick to get 1/4th to 1/3rd funds from their customers to help their insolvency. I hope to see both in jail soon! I thought that Japan is a law-abiding country, but maybe I’m wrong.

Since I learned that Gox eliminated the ability to move anything out of their exchange I’ve just been dumbfounded. Why is there not more widespread news coverage and scandal pieces written about this. I have friends sending me NEW stories about how Gox dropped ~60% in one day and I have to tell them that’s like a week old. What’s the deal here? Hard to believe Bitcoin not big enough for this news to be noteworthy.

Any advice for those holding bitcoin in Mtgox? Sent using Hushmail On Sunday, February 16, 2014 at 7:57 AM, “Bitcoin Trading Signals” wrote: a:hover { color:red; } a { text-decoration:none; color:#08c; } a.primaryactionlink:link,a.primaryactionlink:visited { background-color:#2585B2; color:#fff; } a.primaryactionlink:hover,a.primaryactionlink:active { background-color:#11729E!important; color:#fff!important; } WordPress.com Enky posted: “BTC/USD is trading beneath its 50 day moving average today as I write this, that average is now at $780. Coupled with the high volume on the downside, especially in the last 10 days, this is solid evidence for a reversal of the short term market trend fr”

advice for those holding bitcoin in Mtgox?

yes find a good attorney and sue kerpeles asap

It seems that Gox still functions to a certain extent. I withdrew to fiat from gox on 2014/01/29 and received the money to my account yesterday.

Hi Enky, just saying hi and respect to your hard work. I was a long time owner of 24.7 bitcoins (and reader of your blog) but only recently I dared to do some trading on Bitstamp. Not to make a $ profit, but to obtain a little more bitcoin for things to come. I used the rule “sell high, then buy back low”. I only use 5 bitcoins, sometimes 7 or 10 max, for trading. During the recent Mt Gox issues which, I think, indeed initiated the current bearish market, I managed to obtain almost 2.4 extra bitcoins (that includes my cash position in so-called Limit Orders, so it fluctuates a little). I’m thinking of investing 5 bitcoins in Ethereum (Ether coins) during the upcoming crowdfunding, what would be your thoughts on that?

Thanks, and keep up the good work!

I generally don’t follow altcoins, they don’t offer nothing new except few like mastercoin, xcp counterparty and ethereum. Choice is yours if you want to diversify your investment. I stay 100% in bitcoin for now.

Thanks, fair enough!

Hi Enky,

are you following what’s happening to GOX? big crash today with a lot of big sells as they are going to speak in some hours… so in my opinion is definitely inside trading. Moreover I read that they moved their headquarters to… an HOTEL! I also read that they are preparing to restart the exchange activity as they have found venture capitalist that saved them (they are too big to fails). I would like to know your opinion on these two news: do you think it’s inside trading? if so it must be a bad news coming from Gox and will influence bitstamp and btc-e… and second: do you think that if gox will exchange again BTC and enable also whitdraw, what will be the influence to other markets? I mean, if GOX sell me BTC at 200$, I can send fiat to GOX and withdraw immediately sending them to bitstamp. I really don’t think in a 300% money making, so probably GOX withdrawal will be like a toxic asset and will draw the bitstamp price down to a middle between actuals (400$ ex..).

Do you think it’s time to sell and stay in fiat for a while?

Marco

https://support.mtgox.com/home

i don’t think that mtgox price is relevant as long as withdrawals are stopped. i don’t understand why mtgox customers buy usd, if there are plans only to resume btc withdrawals.

MtGox price is relevant (well, as far as MtGox is concerned at least), but obviously the moment it becomes possible (IF it becomes possible) to withdraw BTC off MtGox, the price there will hit parity with other exchanges and beyond. Sellers will simply withdraw their offers and re-list above other exchanges prices. A few lucky or “well connected” guys would in such a case of course get in purchases of around 500 BTC before the price reaches parity.

The more interesting question is why is the price so far below other exchanges now? The price on MtGox is even lower than would be warranted if you could get your fiat out immediately with no problems, but you can’t, there’s only anonymous evidence even EUR withdraws work. So who is willing to sell their BTC at a quarter of the price on other exchanges, even when the odds of getting their fiat out can’t be higher than getting BTC out? Presumably people who expect the price to go down even further so they can re-purchase and hopefully get their BTC out later. It’s a gamble either way.

Today’s crash was little odd either way, I’m not sure it co-incided with anything specific, and seems to have hit other exchanges as well more strongly than MtGox should affect them now. I’m not sure there’s any announcement MtGox could make now that would “influence other markets” in a meaningful way.

gox is dead, it is still alive just because we are talking about it.

Depends from your investment horizon, i said a couple of month ago that i’m not going to sell my long term btc reserve this year.

Mtgox market is saying one thing and one thing only: bankruptcy is coming. This is the bank run, period. Will it go bankrupt? The signs are all pointing in that direction. This, too, shall pass, and bitcoin will go on…

Enky,

How would you compare this plunge in bitcoin price to the earlier one last year, the one that went up to $200 and plunged back to $5?

it’s totally different now, that drop down to $50 was the conseguence of a huge spike from $13 to $266, now the market is bigger and i don’t think we will never see again an 83% drop in few days

Do you really think mtgox is going to go bankrupt / die? If so, it would be a huge hit to the value of BTC, surely a good opportunity to short or at least exit into fiat. Personally, it seems to me like mtgox is going to start allowing transfers again sooner or later, and as others said there will be a big opportunity for arbitrage as the price normalizes across the exchanges. It would be pretty shocking if mtgox just threw in the towel completely, although I have to admit that I’m pretty shocked about the way they’ve handled everything recently.

Thanks as always for your great technical analysis!

Shocked? do you realize who is the owner of gox?

a puppet, a dumb business man, the only work that Mark Kerpeles should do is probably the cashier at blockbuster.

hi enky, i ran accross your website a few weeks ago and it’s really great. i’m no trader nor experienced. a few months back i invested a bit in bitcoin. but because i needed it for medical fees, i had to sell it entirely for 610 dollars a few days ago. i’m gonna have some money back from the insurance, so i want to know, at which price do you think i should buy my bitcoin back?i thought first that the price would drop to 450 -500 dollars in the short/mid term but i’m not sure anymore

it’s really all i have…

thank you fir the answer

market is still weak, just wait for now.

Eventually you can give it a try buying at my long term support around $420. I’m not sure if the market will drop so much, once the mtgox crysis is resolved we should at least recover the $700 price level

ok thank you! i will wait for now ^^

erm, how much time do you think i should wait? the market seems to recover… i know it doesn’t mean anything, buti’m scared that it stopped it’s fall and it will only recover from now…

these few bitcoin i had was the only money i had and i placed high hopes on it for the future and i really don’t know what to do anymore

I’m afraid the markets are not manipulated by Enky pushing a button. When tomorrow Amazon, Apple and China declare bitcoin the holy currency, the price of bitcoin might go up a little too, despite what’s happening with Mt Gox now.

As I’m quite sure that Mt Gox is a dying dinosaur, I’m not surprised by jumps up that are most probably temporarily signs of life. So I’m waiting a bit more with my last 510 buy trade, after which I’m going in a long term modus again, I think. And that 510 trade might never happen, I’m aware. 🙂

I’ve analyzed the topic of Bitcoin over past few months and it seems obvious that something is going on. We’ ve got a couple of big investments in BTC and that didn’t affect the price in positive – I was thinking what could it mean ? And the only reasonable thing I came up with is that it’s good for the large investment funds that the price gees below the surface…. to buy. Surprisingly ( for an analyst to see so much positive information about BTC market that have completely no effect on the price…. As for options and other financial instruments, the bigger interest the higher the price. But not here – further more one decision of China ( that didn’t make BTC illegal – but said be aware ! scared the hell out of people ) made the price down on it’s knees. And it’ doesn’t matter that two investment funds got around 10 m $ into the deal and the third one promises at least 5% payback. More over as a thought about it I saw something more than that…. The DDoS attacks began as the price had doped… Not when the price was at it’s mid or high… that means the BTC is a prospective currency – because who would want to attack a dead man ?. Only a fool… So for me the recommendation is definitely buy.

Enky, perhaps you can comment on this, and the effect you think it will have on the market, in your next post: http://www.coindesk.com/has-company-found-workaround-mt-gox-withdrawals/

First of all thanks for the link. As for my comment… OK… let’s start at the beginning. If Bitcoin is a crypto currency ( although i treat it more like ordinary shares ) free to all and it’s main advantage is anonymity why the hell did people agree to leave their personal data on this page ? It can vanish with these data any time. Second of all I’ts quite clear that ( for convenience I’ll call it “the government” and it refers to most of governments ) is on the one side scared of the potential of BTC and on the other side see’s a chance to earn money on tax and such ( couple places in the world have it regulated already ). Why scared ? Because of “uses” like silk road. Why an advantage ? Because banks already started investing in it. As for the article and Mt’ Gox I’m quite shocked that people observed patiently the prices at MTG go 20% above the prices on other trading platforms and make nothing of it… There is a mechanism on the market ( and it’s not money laundering ) that allows You to buy resources or share at higher price than the current if Your sure of the profit ( then it’s not dumping ). So finally let’s see the situation in a big picture here….

1) Mt Gox have prices 5, 10, 20% above the regular price what advantage does it give ?

Remember that there are usually two fees in trading… Buy and sell fee – if people bought for higher prices they paid more fee, as well as the people selling ( they paid the fee for a higher price ). The buying fee is usually in BTC ( so MTG must have made quite a reserve, and the sell fees are in the currency – so neither money nor BTC was not the problem for them.

2) The market is getting aware of it.

So people start buying BTC on other platform and selling them on gox that occurs in money shortage ( more sellers than payers ). And that is the moment when the price went down. So what did people do ? Instead of patiently wait for this situation to solve they started selling…. Now the biggest and the tastiest fish in that pool is being cooked…

3) MTG sees that and what ?

If I were in MTG I would invest all my reserves in buying from those that sell for 20% of the regular price… ( and so did MTG as I assume ). And wait for the accurate price to sell on other platforms.I remind You that MTG wasn’t completely down… It’ allowed selling Your BTC’s ( ensuring that the price will do down ).

So in other words only the people who panicked had lost… I’ll bet that MTG has made quite a deal and here ( in the article ) You see the second part of the deal . All markets, shares, resources and currencies can be controlled by causing panic… When there’ s panic the people sell for “a buck” and then the gus that know it;s only a temporary panic – buy… Gues what ? The MTG panic didn’t affect bank’s ( as we’ve seen ) nor the investment companies.

And here comes Your messiah ( there’s always got to be one when panic occurs ). Saying “I’ll slay the dragon for You, I’ll even slay the devil – if there will be one to slay”. So in other words – let’s not overreact – there’s been so much good news lately ( bitomat’s in Sweden, Canada, Germany will be next, and even here in my country i know guys that are considering it for real). And to be honest with You all I was a complete BTC skeptic ( when BTC started and guys bought fist workstations with 7990’s on board ). But I’m an analyst as I’ve said – and one thing I can tell for sure – I’ve seen other markets born in more “pain” than BTC and they are doing great now… So, my recommendation is still Buy.

Gox just started “testing” withdrawals. Does that mean it’s all good? If so, better buy a good sum now…

Not sure if it can be called ‘testing’. Some guy set up Bitcoin Builder to trade in frozen Mt Gox coins, and to some people it feels like Mt Gox is moving again. It is my guts feeling that we are witnessing the last breaths of a once important exchange.

false rumors being spread from some unknown poster on a forum. Bitcoin developer Maxwell already commented on it and said there is nothing to see there and no this prooves nothing on gox and its withdrawals. someone is trying to make money out of spreading rumors, dont fall for it.

And one more thing came to my mind – guy’s ( and ladies ), Get real…. people invested in BTC’s when they’ve were worth 10$/BTC around 6 K USD ( that means they had to mine 600 BTC’s to get payback on the hardware, not mentioning the electricity cost ). And now when one ( of tenth’s ) market is down there is a complete panic. Get over it – even if MTG is dead it means so little to the market that a month from now everything will be normal. Excuse me but when I see grown people panic it makes me pissed ;-)). Have a nice day 😉

Very true… no reason to panic… This type of money is without any doubt the futur…

Mt. Gox Resigns From Bitcoin Foundation

By

Robin Sidel

connect

Feb. 23, 2014 10:08 p.m. ET

Mark Karpeles, chief executive of Mt. Gox, the embattled Toyko-based bitcoin exchange, resigned on Sunday from the board of the Bitcoin Foundation, according to a person familiar with the situation.

The move comes as amid a string of longstanding technical issues that began last summer when Mt. Gox halted customer withdrawals in U.S. dollars. The problems became more severe earlier this month when Mt. Gox halted all customer withdrawals, saying that a bug in the bitcoin software allowed some users to alter transactions.

The problems prompted CoinDesk to remove Mt. Gox from its bitcoin pricing index earlier this month.

The exchange told customers last week that it was still working on “reinitiating” bitcoin withdrawals.

Mt. Gox is one of several industry representatives on the board of the foundation, which is essentially a trade organization that advocates for the virtual currency. Charles Shrem, another board member, stepped down in January after being charged with money laundering in connection with his bitcoin company