Every year i post an outlook using entropic methods explained in the technical section of this blog. Here you can find the 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022 and 2023 forecast update, where you can find more information about this approach.

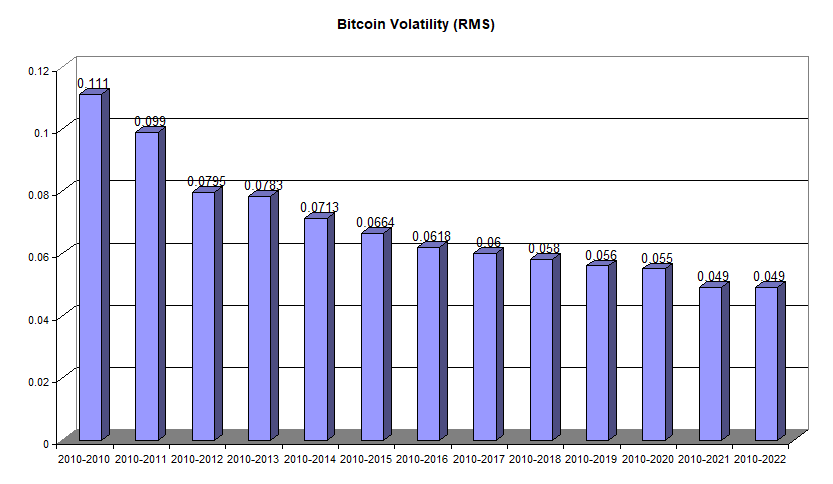

Updated values for bitcoin (in brackets values of 2023) using daily data since August 2010 (from now on I will use only BITSTAMP data, as today there are not many differences between major Bitcoin exchanges.).

| BTC/USD | |

| Growth Factor G | 1.00099 (1.00090 ) |

| Shannon Probability P (see this as entropy) | 0.52237 (0.5214 ) |

| Root mean square RMS (see this as volatility) | 0.0471 (0.049) |

The entropy values of Bitcoin versus the USD have experienced a slight improvement in 2023. The Growth Factor (G) has marginally risen to 1.00099% compounded daily or 144% per year, surpassing the 139% observed one year ago. The optimal fraction of your total wealth to invest in Bitcoin has also slightly elevated to 4.5% (~0.52237*2=1.04475 – 1 = 0.04475 or ~4.5%), a figure that can still be rounded to 5%, similar to last year’s recommendation.

The volatility of Bitcoin has not exhibited an increase this year, considering the average value since the inception of its historical series in August 2010. Currently, it maintains a stable position at a relatively high value when compared to other assets such as gold, stocks, bonds, and forex currencies.

It seems that a volatility plateau has been identified, and it is notably substantial higher compared to other assets. This suggests that Bitcoin continues to be a highly speculative asset. In the year 2023, the growth factor of BTCUSD still outperforms traditional markets significantly, except for the Shannon Probability, which aligns closely with that of the US stock market (around 0.52). This implies that, on average, out of 100 days, an asset rises for 52 days and declines for 48 days.

| 2024 Price forecast | Full Historical Volatility | Half Historical Volatility |

| Forecast using only G* or Growth Factor | ~61,400$ | ~61,400$ |

| Upper bound adding volatility | ~151,000$ | ~96,000$ |

| Lower bound subtracting volatility | ~24,900$ | ~39,000$ |

*61400 is obtained with 1st January as a starting price (around 42650$) times (1.00099^365)=~1.44 | 42650*1.44=~61400$, just change 365 with the number of days you prefer for a different forecast.

What happened in 2023?

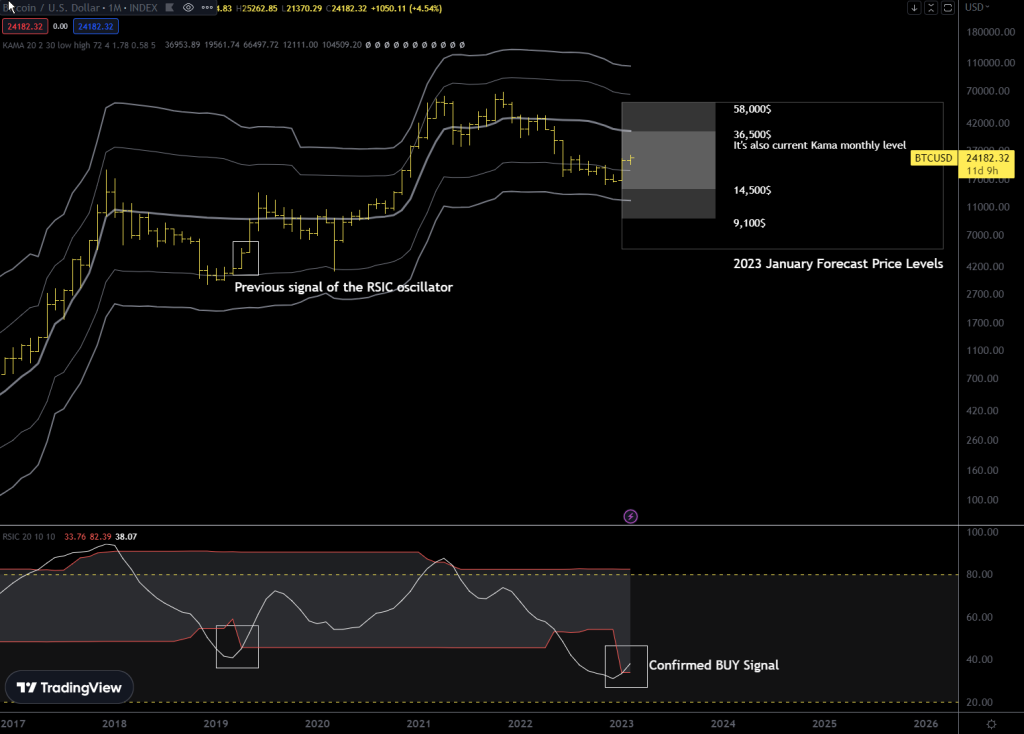

A year ago, I predicted an upper boundary of $58,000 using full volatility and about $36,500 using half of historical volatility, these two targets were calculated based on the opening price on January 1, 2023, which was around $16,500. The calculated support levels were $9,100 and $14,500.

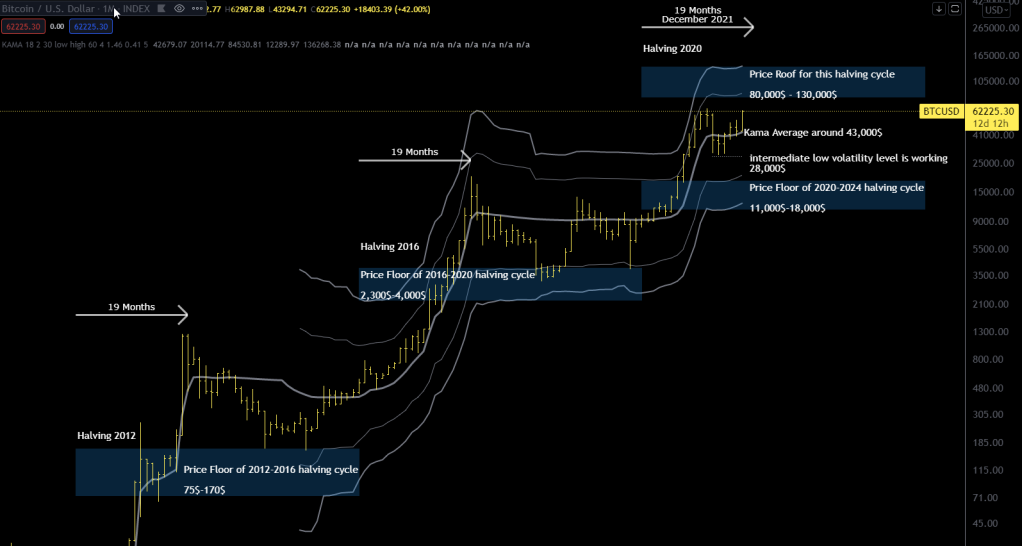

The year has proven positive, surpassing the initial calculated resistance level of $36,500, which coincided with the monthly KAMA average. This signals a notable strength in the uptrend, with BTCUSD transitioning from a position of weakness to one of strength by rising above the monthly average.

Conclusions

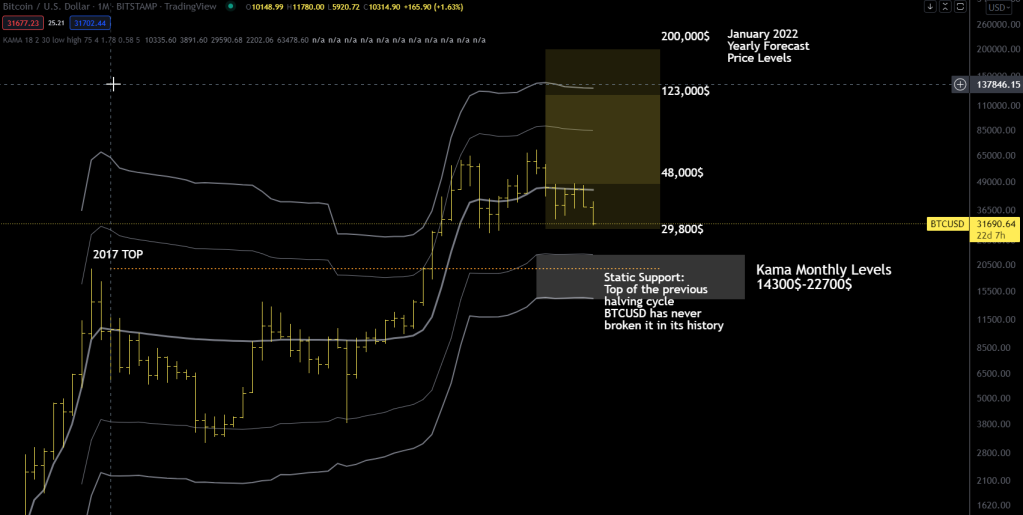

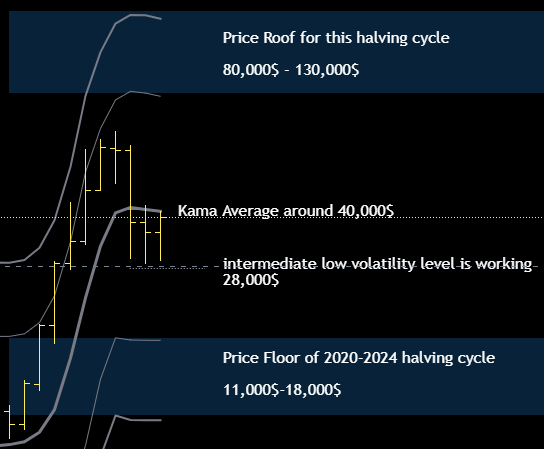

For this year, it might be a smart move to also consider a lower value for volatility, let’s say 25% of the historical volatility, as I don’t expect a new all-time high but rather a consolidation phase a few months before, during, and after the halving. Therefore, determining a resistance level at around $77,000, calculated with a precise 1/4 of historical volatility—a method I don’t typically employ but find plausible for this year. This is due to my belief that it might be challenging for the volatility to remain high for a significant amount of time, making it less likely for BTC to surpass this $77,000 level.

I might consider taking profit if the market shows signs of weakness around this level. I remind you guys that I had opened a bullish position in February 2023 at approximately $22,500.

Furthermore, I have cautious long-term trading recommendations for you this year. The hype surrounding ETFs might culminate in a “sell on news” scenario on the day the ETF gets approved. There’s a possibility of subsequent gradual declines in Bitcoin prices toward calculated support levels for the next year, ranging between $24,000 and $39,000. Don’t forget that the most probable support area is around the monthly Kama, which is inside the support windows for this year ($24,900-$39,000).

Instead of anticipating any catastrophic scenarios this year, in contrast to the previous year, which appeared more susceptible to bearish scenarios, I maintain my view of the $24,900 support as very solid.

About the upper bound i’ve to admit that it is very unlikely to reach and/or break $151,000 during 2024.

I’m at your disposal for any questions; see you at the next update and Happy New Year!

Charts

I’ve added the equilibrium point computed using the G growth factor at $61,400.

The chart is monthly and begins at the end of November ’22 bottom.