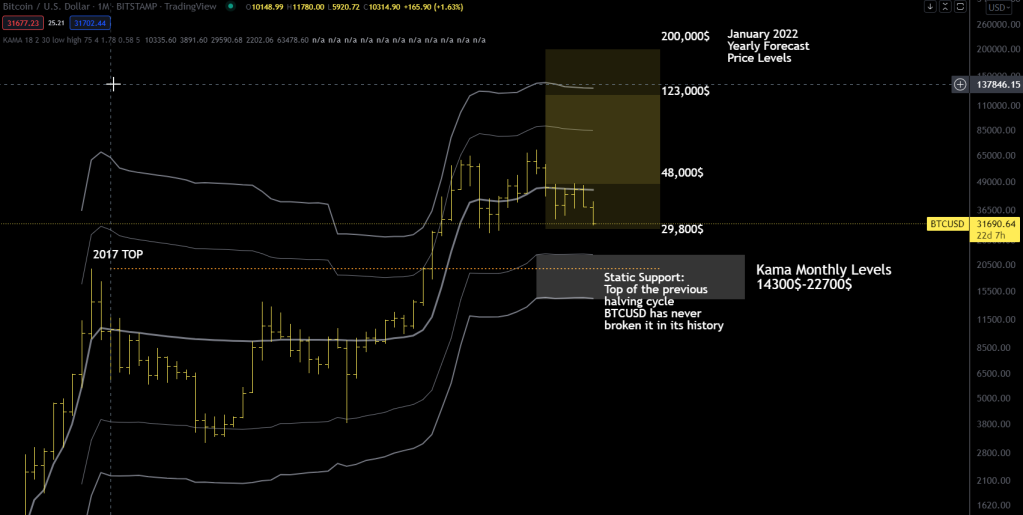

Since I published the annual forecast last January ’22, BTCUSD has already tested the lower limit of the forecast twice, at around $30,000.

I don’t know whether to interpret this behaviour as a sign of weakness or not. What is certain is that if the TOP of this halving cycle has been made it is very likely to test at least the 1st lower band of my monthly Kama average (22,700$).

Let’s see in detail the levels that I consider interesting to observe.

I would interpret as a signal of possible weakness a breach of the $29,800 level, certainly we need to consider how long bitcoin will remain below that level.

In times of temporary high volatility it would not be so serious a short permanence there; however a prolonged stay below this level would have long term bearish implications. What does this mean? It means that the games are over for this cycle and we will have to wait for the next halving of 2024, so I would say 2025, to see a new all-time high. This conclusion I guess doesn’t surprise you, by now the 4-year halving cycle of bitcoin is well known to the public.

The question is whether the price will stop at the first level of the Kama band or not. I think so, around $22,000 the support will be very strong and there will be buyers.

I exclude a severe test at the next support, around $14,000, also because bitcoin has never moved below the high of the previous halving cycle, in this case the last one was at around $19,800 in Dec. 2017; furthermore even during the corona crash the price stopped on the first lower band (at that time $3,800)

I wonder what needs to happen to see bitcoin test the second price band at $14k, if any of you have ideas please come forward 🙂

Personally, I will be a buyer again around the first support of the Kama average, around $22,000. Should an extreme level of volatility occur, I will increase the position at $14,000 with a doubled position size (1 unit at 22k$ and 2 units at 14k$) because i’ve to capitalize when volatility is at extreme levels without any fear.

See you at the next update.

Hey Enky, thanks for the update!

“I wonder what needs to happen to see bitcoin test the second price band at $14k”

How about a World War III where a bunch of critical infrastructure that holds up global internet gets destroyed. It can be just a brief period before it gets repaired, but it is going to call into question some fundamental things and cause panic.

Dude WWIII would most likely be the end of civilization. Most critical ressource would be uncontaminated water/food to at least have a small chance of survival. The least concern should be the btc price, and the whole WW3 thing is off the table anyway, so in my view absolutely nonsence to consider WW3 in investment strategy.

If you really wanna mitigate ww3 risk build a bunker in southern argentina, stock water/food supply for a few years and keep staying there. -> thats probably the only way to effectively mitigate this risk

I don’t want to live in a bunker:) Better to die instead in case of WWIII

You are assuming WW3 has to involve nuclear weapons. Which it does not. It is just something people assumed would happen in their arguments that we must do everything to prevent it. If this 3 month war showed us anything, it is that countries are perfectly happy to duke it out conventional way.

You already have war in Europe. You have Israel preparing for Iran invasion. You have China poised to attack Taiwan for a long time now. You have Japan pushing to make changes in their constitution from strict self-defence and declaration that Kuril islands are illegally occupied. Entire world is strained by conflicts ready to erupt. Our history is full of wars, we were just lucky to be born in an era that has not seen major conflicts for awhile. Dismissing wars as impossible is the foolish thing to do, not the other way around.

Life will go on as it always does and no it does not have to be some nuclear wasteland. Damage will be done and it will be repaired. Trade will continue and there will still be need for currencies, digital or otherwise.

Soon, after collapse Dome of the Rock, nuclear war is started.

Prophecy, Joseph Vatopedi.

US, Europe, Russia, Turkey, will killed 1 billion peoples.

Hey Enky!

I’m curious what allocation in percentage terms you have now in crypto versus your total capital invested across all the markets. And what percentage you want to add around 22k if such drop happens?

Thanks!

as a long-time miner I have a reserve of btc. i’m 85% in crypto at the moment.

I don’t think bitcoin will go back up anytime soon so i’m not adding at 22k i prefer to wait and see because it’s not out of the question to test the other support at $14k in the coming months.

Thanks for commenting your thoughts again Enky, much appreciated.

/phel

BTC stable above the support level at 22k again last 24 hrs it seems like? Might add some in the upcoming hours.

Did you add? After 20 days not much happened. Resistance remains 26k usd, daily kama bands.

Thanks, was unsure of an actual break, added a minimal sum at 22k. Bigger sum ready in case of a break of 26k, or a new dive towards lower levels. Do you, even after some months here, still consider 14000 as support if we go all the way down?

Hi, I am starting to be a bit pessimistic about whether it can hold support at $13600 (second monthly price band of my average) especially because of the current gepolitical situation and the fact that the federal reserve has stopped printing money; whether we like it or not the price of bitcoin is correlated with it hence my skepticism about that support working out.

You should look for the end of the bear market probably the price area between 6600$ and roughly 8500$. I will explain why this support area in the next update when I will do it.

Too conclude too many people are buying this bottom based on theories, supports, expectations that have always worked in the past. This is not allowed in the markets, the variability of things is a fundamental element and cannot be violated, a market cannot become too repetitive or predictable as this one in cryptocurrencies is becoming.

You must always remain flexible and be open to what seems impossible to you today.

Bye

Thanks for answering and your thoughts Enky. This correlation is important to take in consideration I think aswell. And about your input regarding the psychology of trading and the importance of being aware of to much repetition and open to the impossible, I also think this definately might be applicable in this case. Good sign to see the advisor remains flexible. 😉

Will this change your portfolio crypto percentage (85%?)? Looking forward to your next update.

I see. I added around 1% of capital to my position at 24k today. But probably will wait with adding more until 20k is breached. I’m starting to think last ATH at 19800 will be breached. Markets often do such things to generate maximum FUD. Also someone big might be playing against Celsius right now. Celsius may be margin called if BTC drop is deep enough. Hence much lower prices might be in the cards to force Celsius to liquidate its positions. Its far from certain but I have a feeling this may be incoming.

it’s like stretching a rubber band, the further you go, the harder it is to maintain the distance from the starting point. The kama average at $45000 is the midpoint of the cycle, the further you move away from it, the harder it is to stay there for a long time. Very unlikely to go below 14000$ in this 4 year cycle, bitcoin is designed to always go up there is no alternative, it either goes up or it dies. Below 14000 it is dead.

Translated with http://www.DeepL.com/Translator (free version)

Margin vs Exchange liquidity looks like its possible to go way below 14k temporarely. I agree technically a breach of 14k wouldnt look good, anyway this is a special situation where fundamentals are still strong/didnt change and might be more valuable than technicals. Anyway what is your take when you open a long position around 14k – are you going to set a stop loss?

In my view the fed is serious about fighting inflation (months), anyway i dont think they can keep this course over the long term (years). So fundamentally BTC vs Fiat didnt in my view change in a long term perspective.

I agree with you about the fundamental of btc that hasn’t changed. I’ll buy some options at 14k, no stop loss, i’ve time against with options so the take profit will not be too far away.

Why options? You do not want to add more spot for long term position? Just short/mid term speculation with options?

Exactly, I’ve enough long term spot position outside the trades i post here.

OK, if you are 85% commited to crypto right now then no need to add more. Gotcha.

Should we worry? With electricity prices going through the roof and btc dropping to $20k … ?

I expect a further decline from here, read my response to Phel in the comments.

Your last comment is very interesting Enky. I do agree people expect repetition of previous bear market. Everyone measures percentage of last decline and talks how low we could go. They also calculate number of days last bear markets took and expect we will see similar outcome this time. Prices below 10k sound low but crypto taught us everything is possible. Do you still believe this would be the end of Bitcoin or just temporary decline to scare everyone? Looking forward to your next update. Cheers!

Hi, this is not the end of crypto but temporary decline to scare everyone out. Next update? i’ve not much to say honestly, the yearly forecast failed to contain the drop, the last support for this year was 29800$, market is undoubtedly weak.

Hi, Markets always change. We make predictions based on past and sometimes they work but after some time market changes and they stop working. Then after a while they might work again. In your next update you could publish current monthly KAMA levels and comment a little bit on the market. Would be good to read you every 6 months or so. Stay healthy there 😉

Hi Enky,

Some say that a breakout just happened.

I feel that it is the temporary USD weakness showing on the BTC chart.

Can you see a W bottom forming or is it just hopes too high? 🙂

Very curious about your opinion.

Hi,

Sorry for late reply but i don’t check the blog daily.

I developed a new model to failry price BTC; this model has a 20% tolerance above and below the estimated fair price.

Levels for these days are:

12600$ lower band

15850$ model estimated fair btc price

19000$ higher band

I think i’ll probably start to accumulate once the price will move in the lower part, between 12600 and 15800 usd.

Best Regards

11-17-2022

I refined the model, new levels are:

11700$ lower band

14650$ model estimated fair btc price

17600$ higher band

Hey Enky! What’s your feeling? Is the low in? 🙂

IT could be, as i said to another guy i’ve a new model to price btc, 14600$ is the price for these days.

I’m going to wait and see if the price will move lower, between 11700 and 14600 before starting to buy again.

CU